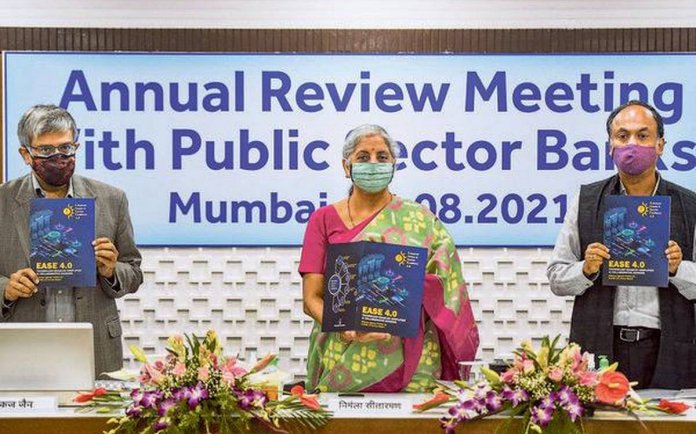

Hello fellows! Hope you all are doing well. As you all know, Finance Minister Nirmala Sitharaman unveiled a roadmap to transform all public sector banks (PSBs) into “digital-attacker banks”.

They are working hand-in-hand with key constituents of the financial services ecosystem to offer the industry-best customer experience.

Aim :

The fourth edition of the EASE (Enhanced Access and Service Excellence) aims to further the agenda of customer-centric digital transformation and deeply embed digital and data into PSBs’ ways of working.

In addition, A common reform agenda for PSBs, EASE Agenda is aimed at institutionalizing clean and smart banking. It was launched in January 2018, and the subsequent edition of the program ― EASE 2.0 & EASE 1.0 furthered the progress on reforms. EASE 3.0 was launched for Financial Year 2020-21.

Key features of EASE 4.0 :

- EASE 4.0 commits PSBs to tech-enabled, simplified and collaborative banking, the Indian Banks’ Association (IBA).

- It has catalysed the accelerated implementation of several initiatives and has injected greater customer-centricity into PSBs’ business model and processes.

- PSBs have fundamentally re-oriented their ways of working to align with EASE methodology and have made concerted efforts to deep-root reforms and maximise the value derived from them.

Under EASE 4.0, PSBs to offer :

- 24×7 banking: Under EASE 4.0, according to the IBA statement, the theme of new-age 24×7 banking with resilient technology has been introduced to ensure uninterrupted availability of banking services by ensuring 24×7 availability of select banking channels, improving the reliability of technology platforms, and aligning internal processes in the PSBs to deliver such services.

In addition, several new reforms such as increased use of digital and data for agriculture financing through partnerships with third parties for alternative data exchange, driving impetus on digital payments in semi-urban and rural areas, at-scale adoption of doorstep banking services for PSB customers, etc are also added.

- Bad bank: A bad bank is very close to getting a licence, said Sitharaman. Indian Banks’ Association has applied to the RBI and a licence for the bad bank is expected soon. The Finance Minister also stressed that under the National Monetisation Pipeline there will be no change of ownership and ownership of assets will remain with the Government.

- North-East to be focussed: Banks have also been asked to come up with specific schemes for the North-East. Sitharaman also highlighted that the high CASA deposits in the Eastern States are a matter of concern & banks should give a facility in the region for greater credit expansion. Furthermore, Banks, financial services, and insurance have been identified as strategic sectors.

- Inflation: It is expected that inflation will come down once the crops are harvested. The RBI guided, the inflation, which is a little on the up, will cool down in some time, and we also feel that once the crops come out, inflation should come down & it would remain within the target of 4-6 per cent.

There was another highlight which included SBI, BoB, Union Bank of India winning the top awards for PSB Reforms EASE 3.0.

Public Sector Banks have reported healthy profits and have accelerated technology-driven reforms.

- The overall performance of the PSBs greatly seemed to rise this year. This is the first year when PSBs has reported a profit after five years of losses.

- Number frauds at PSBs have substantially come down to 2,903 in Financial Year 2020-21 compared to 3,704 in Financial Year 2018-19.

- Top 7 PSBs have set up mechanisms for instantaneous and contactless access to credit through end-to-end digitalisation of key retail and MSME credit products. Nearly 4.4 lakh customers have been benefited through such instantaneous and simplified credit access.

- PSBs have a setup mechanism for customers where they can register loan requests 24X7 through digital channels such as Mobile and Internet banking, SMS, missed calls and call centres.

- PSBs have built analytics capabilities through the setup of dedicated analytics teams and IT infrastructure to proactively offer loans to their existing customers. Such loan offers were generated using the existing customer transactions data within the banks.

- Nearly 72% of financial transactions happening at PSBs are now happening through digital channels (increased from 3.4 crores in the quarter ended March 2021 to 7.6 crores in the quarter ended March 2021).

- 96% of PSB branches now have at least one officer fluent in conversing in local languages.

- With the deployment of IT-based Early Warning Signals (EWS) systems nearly complete by all PSBs in EASE 2.0, coverage under EWS has also increased significantly. INR 33 lakh crores loan book covered under EWS at the end of March 2021.

So with this, we came to the end of this detailed blog. For more interesting & informative blogs, stay tuned.

Thank you!